We all know that “cash is king” or “money talks” but when it comes to the high stakes game of buying in the NoCo real estate market, when you put your money where your mouth is, you’ll likely come out on top. Never before have we seen a real estate market this constrained by low inventory. If you’ve participated in the market over the past two years, you’re familiar with multiple offers, waived contingencies and escalation clauses. All signs are pointing towards consistently higher sales prices for the foreseeable future. IRES, the MLS covering Boulder, Broomfield, Larimer and Weld Counties, reported that the regional median home value for the 1st quarter of 2015 was $310,000. After closing out the 1st quarter of 2016, we’ve already gained 7.8% to $334,250. Buyer demand has never been stronger or more competitive. It takes incredible decisiveness and for lack of a better phrase, intestinal fortitude, for buyers to make these incredible offers. Real estate professionals are seeing offers above list price, sight unseen offers, heartfelt letters and all kinds of interesting tactics to win the bidding process.

THE CRAFT BROKER

NORTHERN COLORADO HOMES

NoCo Real Estate Market is Flooded With Cash

The Craft Broker

I wanted to get above the noise and intensity of the current market and take an objective approach to really understand what financing helps buyers win bids and what impact financing has on the real estate market and the regional economy as a whole.

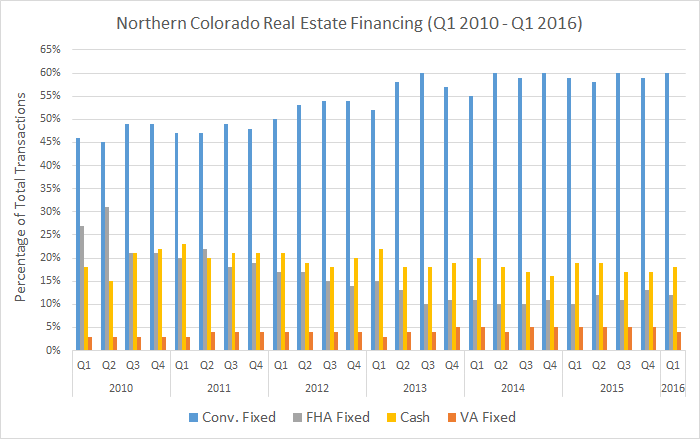

I started by looking at the financing of both attached condos/townhomes and detached single family homes in the NoCo real estate market; Boulder, Broomfield, Larimer and Weld Counties. There were only four primary financing instruments that represented the majority of transactions: Conventional Fixed Rate, FHA Fixed Rate, VA Fixed Rate, and Cash. There were some instances of adjustable rates or private/owner financing that made up the balance.

For reference, conventional loans are generally reserved for borrowers with higher credit scores and downpayments between 5%-25%. FHA borrowers generally put down between 3.5%-5% and VA borrowers are able to utilize 0% downpayment options because of their Veteran’s benefits.

The king of financing is the conventional fixed rate, accounting for nearly 60% of all sales since 2014, up from an average of 47% in 2010 and 2011. Next up, an incredible 1 out of every 5 home sales in the Northern Colorado Region is a cash deal, averaging about 19% of transactions since 2010. FHA fixed rates transactions averaged just 11% of total transactions and VA loans remain a very steady 5%.

The trend of higher down payment or cash transactions proves the ‘cash is king’ theory. If buyers are able to bring more to the table, they have the ability to beat out more leveraged offers, often seen as weaker or less financially stable. Cash offers or higher down payment offers also have the advantage at the time of appraisal. Cash offers have no appraisal contingency, so sellers can rest easy knowing it’s just one less hurdle to jump. Conventional borrowers have more skin in the game, making it a less risky loan for the bank or investor.

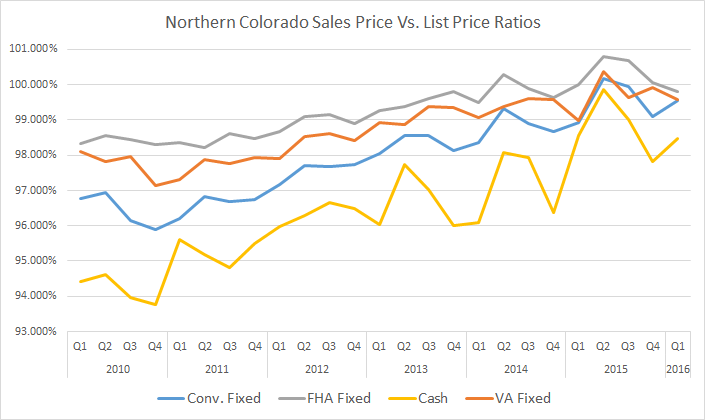

Incredibly, putting down more to win a bid doesn't mean you're paying more to get into a home. In an analysis of sales price versus list price ratios, it's obvious that cash and conventional financing will get you the better deal (see the chart below). Over the past 5+ years, cash transactions sale to list price ratio is 96.49%, while FHA ratios average 99.27% over the same period. Although a 2.78% difference might not seem like much, on a typical $325,000 home, a cash buyer will receive a $9,035 discount as compared to an FHA borrower. Another reason why cash is king. How 'bout them apples?

Although analyzing real estate financing might not be very sexy, the picture it paints points to a very strong, sustainable and healthy real estate market and regional economy. Stronger financing shows us that Northern Colorado homebuyers are more financially stable and savvy, likely due to the area’s incredibly low unemployment and diverse job market. Borrowers are pouring more money into their homes and have higher levels of equity for every purchase. Couple that with the fact that higher down payments provide lower monthly payments and any bump in the road or recession can be more easily weathered. Equity in every home comes back into the local economy when homeowners refinance to renovate, having the added bonus of improving the overall housing stock in Northern Colorado. If you’ve got cash, the Northern Colorado real estate market is a great place to put it to good use.

About the Author: Jared Reimer is a native Coloradoan and an Associate Broker at Elevations Real Estate in Old Town Fort Collins. He’s a community advocate, business champion, blogger, leader, tireless volunteer, innovator, thinker and expert on all things real estate in Fort Collins and surrounding Northern Colorado. You’re likely to find Jared spending quality time outside with his wife, Kacie, and young son, Hudson, or sharing a beer or two with a friend throughout Fort Collins. Call or text Jared at 970.222.1049 or email him at Jared@TheCraftBroker.com